As freight demand continues to rise across Australia, many transport businesses are scaling up to keep pace. But new data shows that growth may come with added risk. According to the 2024 NTARC Major Crash Report, crash rates are climbing fastest among larger fleets.

This trend suggests that once a fleet reaches a certain size, managing safety becomes more complex. It’s not just about having more trucks on the road, but about how well risk is mitigated across the board.

From driver onboarding to vehicle oversight and insurance strategy, this article explores why larger fleets are seeing more incidents and what operators can do to reduce their exposure.

The Stats Behind the Spike

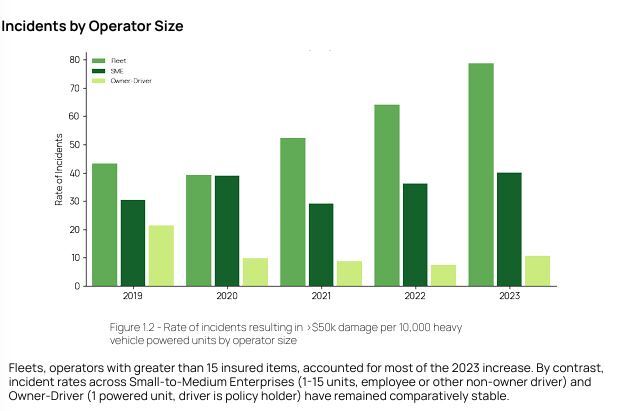

The NTARC report breaks down crash involvement by fleet size and the results are hard to ignore. Operators with 15 or more trucks saw the highest increase in crash frequency compared to previous years.

In contrast:

- Small fleets (1–5 trucks) showed little change in incident rates

- Mid-sized fleets (6–14 trucks) experienced more moderate growth

This pattern is also supported by findings in the 2024 BITRE Yearbook, which highlights that larger operators are moving a growing share of the freight task. As businesses grow to meet rising demand, the challenge isn’t just keeping trucks on the road, it’s keeping safety practices consistent across a bigger, more complex operation.

For example, take a freight operator managing 25 trucks across three states. With multiple depots, a rotating pool of drivers and a mix of new and ageing vehicles, what worked at 10 trucks may no longer be enough. One missed pre-start check or a miscommunicated fatigue rule can lead to a serious crash and the ripple effect can stall deliveries, trigger liability claims and strain customer relationships.

(Source: Major Incident Investigation Report 2024)

Why Are Bigger Fleets Having More Crashes?

You’d think a bigger business with more resources would be safer. But managing a large fleet isn’t just about managing more people and vehicles, it’s also about keeping everything consistent. Something that can become significantly harder as a business expands.

Here are some of the key reasons large fleets might be seeing more crashes:

- Different drivers, different standards: Larger fleets often rely on a mix of full-time, casual and subcontracted drivers, which makes it harder to maintain the same safety standards

- Older vehicles in the mix: Big fleets may use a range of trucks, some newer and some older, which can lead to inconsistent maintenance schedules

- Communication gaps: With multiple depots or teams, it can be tricky to keep everyone updated on safety rules, incident reports or changes in policy

- Too much data, not enough action: Larger fleets collect a multitude of driver and vehicle data, but if there’s no system to review and act on it, it doesn’t help reduce risk

One Crash Can Hit Hard

Of course, a single major crash doesn’t just damage a truck, it can have a serious knock-on effect, disrupting operations and potentially costing a business hundreds of thousands of dollars.

Common related costs include:

- Vehicle repairs or replacement

- Missed delivery deadlines

- Third-party damage or injury claims

- Legal and investigation costs

- Loss of customer trust

As specialist truck Insurance broker, Insuregroup, explains:

“These numbers reflect what we’ve consistently seen over the years. Bigger fleets often face more risk just by the nature of their operations. But not all of them have adjusted their insurance or internal processes to keep up. It’s not only about having a policy, it’s about having appropriate protection that aligns with your actual day-to-day risks.”

What Can Larger Fleets Do to Stay Safer?

While there’s no one-size-fits-all solution, there are some practical steps that larger operators can take to reduce crashes and avoid bigger financial and operational impacts.

- Strengthen Driver Onboarding

Every driver, whether full-time or casual, should go through the same safety training. This should cover things like fatigue management, load safety, speeding and what to do after an incident. - Use Telematics Wisely

If you have vehicle tracking or dash cams, use the data to spot risky driving early. Set up regular reviews and provide coaching and useful guidance, not just criticism or warnings - Run Regular Safety Checks

Larger fleets need routine audits to check that policies are being followed and that vehicles are in top condition. Make sure inspections cover every depot, not just the head office. - Share Lessons After Incidents

When something goes wrong, take the time to investigate it and share what happened across the business. Where possible, use real examples to highlight these concerns and contribute to improving future performance. - Review Your Insurance Strategy

Make sure your current cover actually reflects the size and type of work your fleet does. This includes:

– Checking limits and excesses

– Listing all vehicles and drivers correctly

– Making sure any subcontractors meet insurer requirements

– Asking about loss prevention programs or risk support services

Why Insurance Needs to Evolve With the Fleet

When fleets grow quickly, insurance can often become an afterthought. But the bigger the operation, the more specific your cover needs to be. An insurer needs to understand how your business runs day to day, what routes your trucks are on, how drivers are trained and how incidents are managed internally.

If you’re not sure how to approach this or what the next steps should be towards achieving this, the right broker can help you build a strategy that goes beyond just ticking boxes. It should align with how your fleet actually operates, so that when something happens, you’re covered in more ways than one.

Looking Ahead: What This Means for the Industry

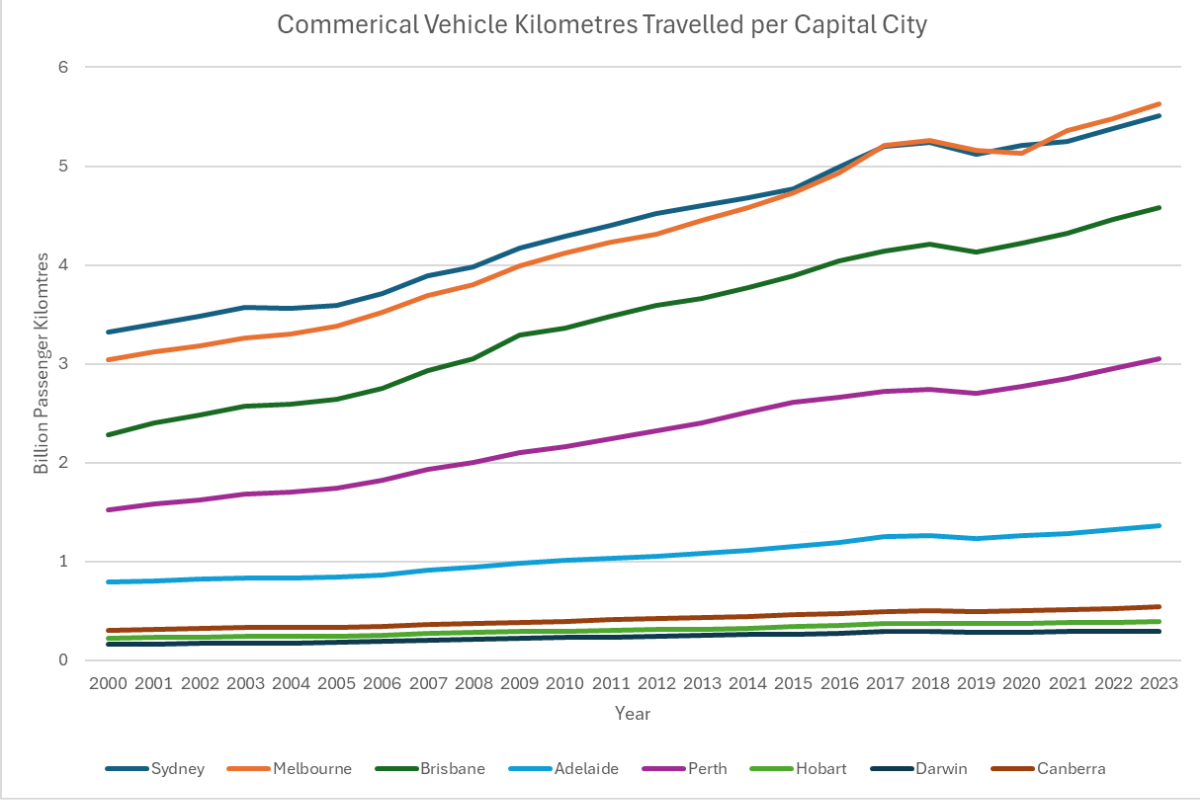

With the freight task continuing to grow each year and larger companies taking on more of the load it’s likely this trend will continue. The BITRE report shows freight vehicle kilometres travelled are rising steadily, which means more pressure on drivers and equipment.

(Graph: Commercial Vehicle Kilometres Travelled per Capital City. Data source: Australian Infrastructure and Transport Statistics Yearbook 2024)

At the same time, regulators like the National Heavy Vehicle Regulator (NHVR) are paying close attention to safety compliance and chain of responsibility. Larger operators may face tighter scrutiny if incident numbers continue to climb.

However, this shift isn’t all bad news, it also opens up new opportunities. Businesses that put the right safety systems in place early and work closely with their insurers can put themselves in a stronger position. Safer fleets are often rewarded with better insurance rates, fewer delays and stronger relationships with clients. In a competitive industry, managing risk well isn’t just about keeping compliant, it can help your business stand out too.

Final Takeaway: Growth Needs Guardrails

There’s nothing wrong with growing your fleet, after all, growth often signals success, but it needs to be supported by structure, especially when it comes to safety and risk. The latest NTARC data makes one thing clear – larger fleets face more crashes, not because they’re careless, but because complexity makes consistency harder.

The upside? These risks can be managed with the right mix of strong processes, consistent training, smart use of data and a risk-aware insurance strategy. With those in place, large fleets can keep moving safely, no matter how fast the industry shifts around them.